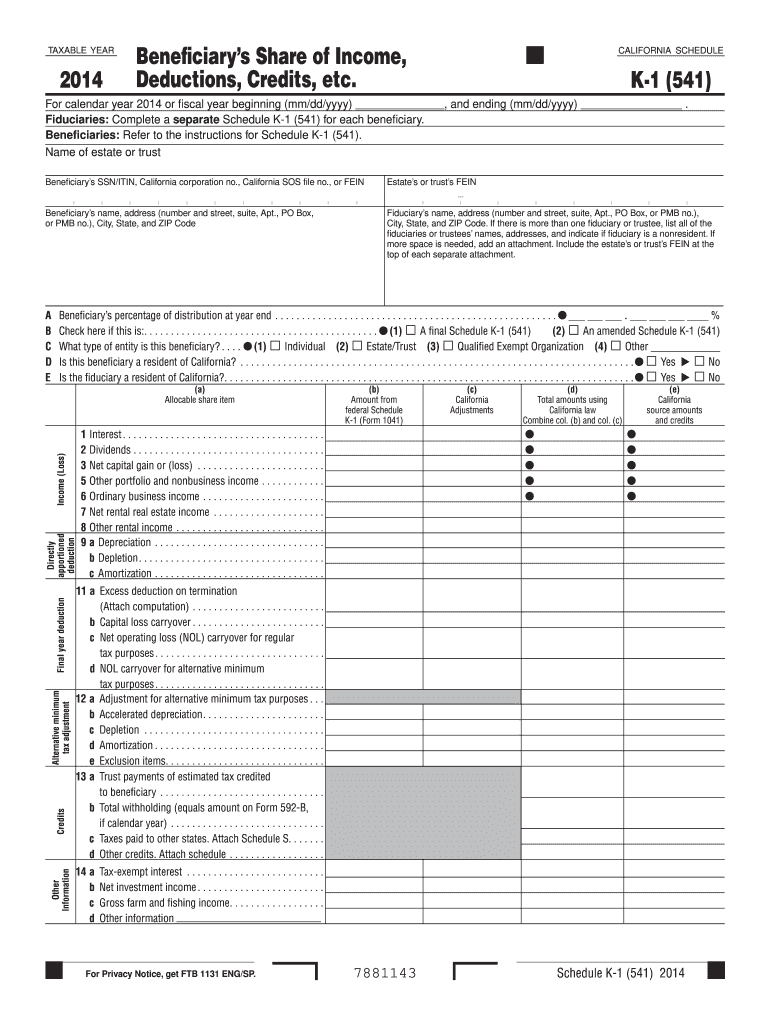

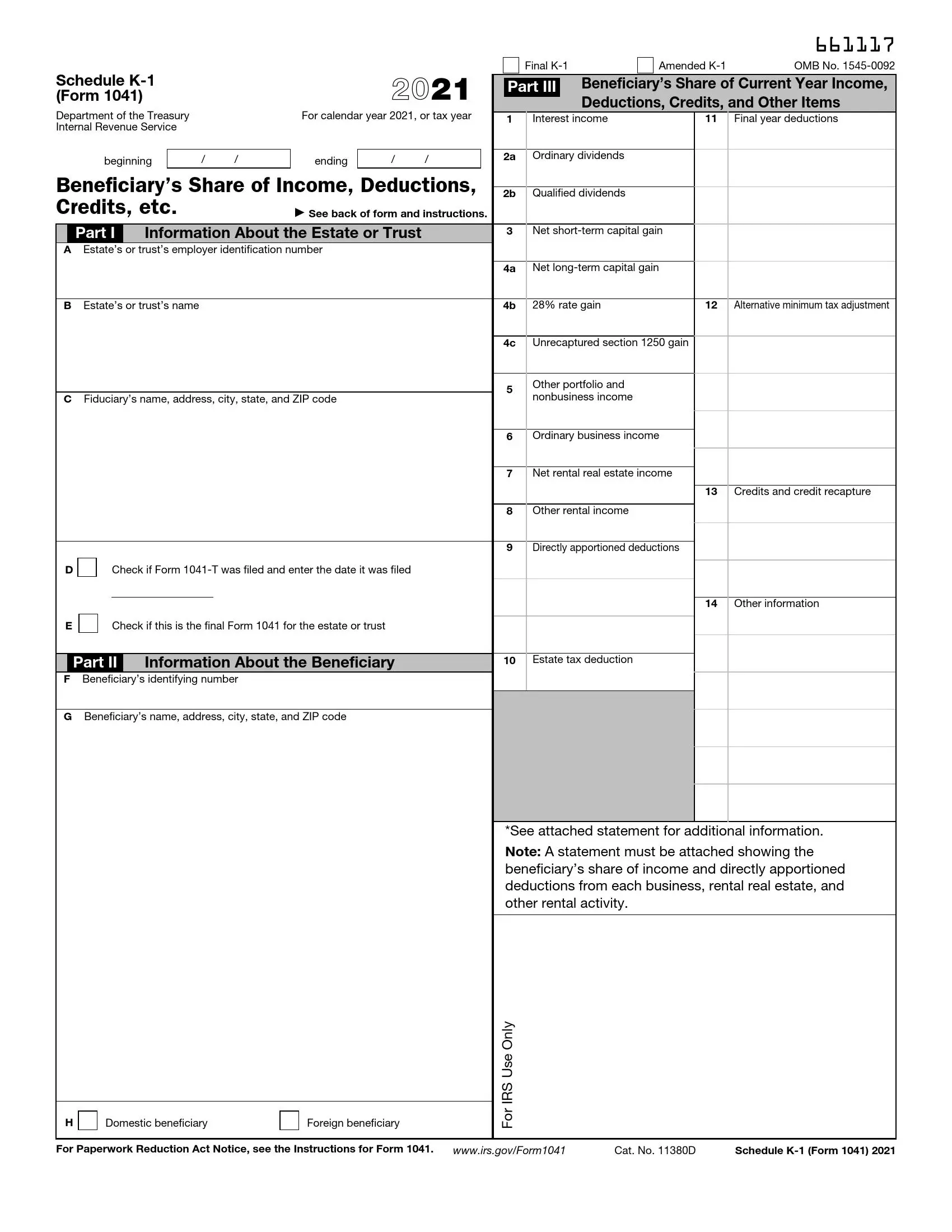

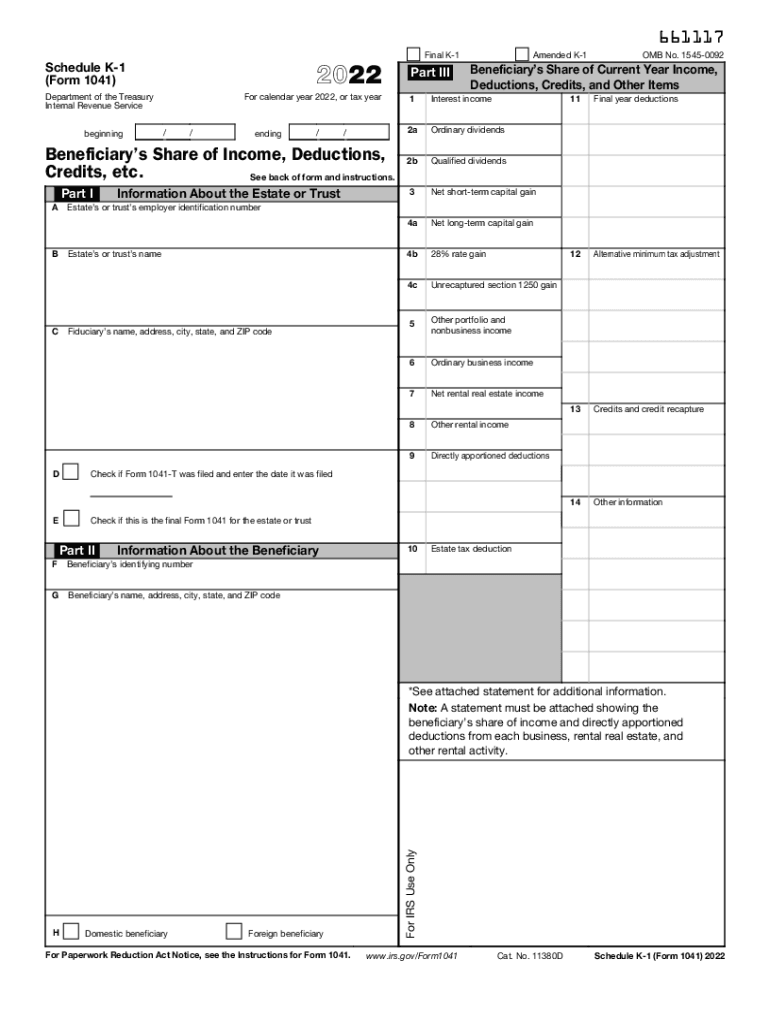

2024 Irs Form 1041 Schedule K-1 Form – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . The return prescribed by the Secretary for the reporting of a trust’s taxable income is IRS Form 1041, and the Schedule K-1 is made a part of that return. The instructions promulgated by the IRS .

2024 Irs Form 1041 Schedule K-1 Form

Source : www.nelcosolutions.comK1 tax form: Fill out & sign online | DocHub

Source : www.dochub.comWhat is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax

Source : turbotax.intuit.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comIRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comIRS Instructions 1041 Schedule K 1 2022 2024 Fill and Sign

Source : www.uslegalforms.comWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comIrs form k 1: Fill out & sign online | DocHub

Source : www.dochub.comWhat Is IRS Form 1041?

Source : www.thebalancemoney.comSchedule k 1: Fill out & sign online | DocHub

Source : www.dochub.com2024 Irs Form 1041 Schedule K-1 Form 1041K1104 Form 1041 Schedule K 1 Fiduciary Return Bond : Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a . You’ll get a copy of a form, called Schedule K-1, telling you what your share is. The IRS gets a copy, too. Members of an LLC that is taxed as a partnership use the information from Schedule K-1 .

]]>

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)